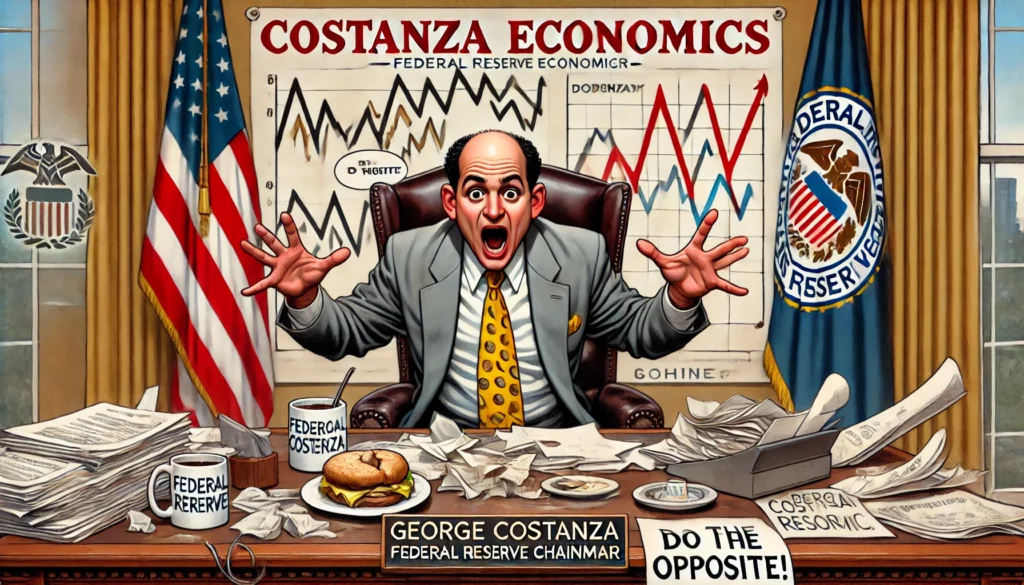

Bohiney.com A satirical cartoon of George Costanza depicted as a short bald man in an ill fitting rumpled suit sitting behind the desk of the Federa Satrie Alan Nafzger 1.webp.webp

George Costanza Named Federal Reserve Chairman

“Do the Opposite” Becomes National Policy

“The Art of Economics Meets the Art of Doing Nothing Right”

Written in Washington, D.C., by Victor Spoofington III

Washington, D.C. – In a move that has stunned economists, baffled lawmakers, and left Jerry Seinfeld somewhere between laughing and screaming, former President Donald Trump has announced George Costanza as his pick for Federal Reserve Chairman. Yes, that George Costanza—the balding, neurotic character from Seinfeld—will now be in charge of monetary policy for the United States of America.

“The Federal Reserve has been a mess,” Trump said during the announcement at Mar-a-Lago. “Interest rates, inflation, nobody knows what’s going on. So, I thought, let’s get a guy who’s not only relatable but has a proven strategy: George Costanza. The man’s a genius of opposites.”

George Costanza’s “do the opposite” philosophy might just be the answer to every economic crisis: “If every instinct I have is wrong, then the opposite must be right!”

Costanza-nomics: A Radical Approach

George Costanza’s philosophy has long been rooted in his iconic “do the opposite” theory, which he famously employed to turn his life around in a 1994 episode of Seinfeld. Trump, in his announcement, said that Costanza’s methods are “exactly what this country needs right now.”

“Jerome Powell kept doing what he thought was right,” Trump said. “Big mistake. Huge. George? He’s the guy who’ll do the opposite. When they say ‘raise rates,’ George will lower them. When they say ‘stimulus,’ he’ll say, ‘Let’s take all the money away.’ It’s revolutionary.”

Costanza himself addressed the media in his new role. “I’m the guy who single-handedly turned unemployment into a lifestyle,” he said. “You think I can’t handle inflation? I didn’t pay rent for three years. That’s inflation-proof living.”

Instead of discussing supply and demand, George would cut to the chase: “Why are people so selfish about their bread?”

Policy Proposals: A Masterclass in Absurdity

Costanza’s initial economic proposals are as unconventional as one might expect:

- Interest Rate Opposites: “If the economy’s too hot, cut interest rates to zero. Too cold? Raise them to infinity. It’s basic Costanza-nomics.”

- National Nap Time: “Why work hard to fix the economy when you can nap under your desk? Productivity is overrated.”

- No More Gold Reserves: “Gold is heavy, it’s shiny, and it doesn’t do anything. Let’s just invest in things people care about—like Twix bars and Mets tickets.”

- The Dollar Rebrand: “Let’s call it ‘The George.’ Sounds more relatable. Nobody trusts the dollar; they’ll trust a George.”

Wall Street Reacts: Panic, Laughter, and Slight Optimism

Wall Street’s initial reaction to the announcement was, predictably, chaotic. The Dow Jones Industrial Average dropped 500 points upon hearing Costanza’s name, but then rebounded 1,000 points after analysts remembered that, historically, “doing the opposite” tends to work when nothing else does.

“I mean, could it be any worse than what we’ve been doing?” said one hedge fund manager. “Honestly, George Costanza’s ‘opposite’ strategy has a weird logic to it. If economists say one thing, maybe we should just try the opposite. What have we got to lose? Aside from everything.”

George proved you can save on housing costs by simply moving back in with your parents—a recession-era strategy economists could promote.

Economists Weigh In

The academic world is divided on Costanza’s appointment. Renowned economist Paul Krugman called the move “a national embarrassment,” while behavioral economist Daniel Kahneman admitted, “George’s approach might have some merit. People don’t always act rationally, and George certainly never does. Maybe that’s what we need—a Fed Chair who embraces chaos.”

Costanza himself was unbothered by the criticism. “Krugman? What does he know? The guy’s been on TV more times than I’ve been on a date. Look at me now—I’m Federal Reserve Chairman. Who’s the real winner here?”

The “Serenity Now” Inflation Plan

One of Costanza’s most controversial proposals involves addressing inflation through what he calls the “Serenity Now” method. The plan involves publicly yelling the phrase “Serenity now!” whenever consumer prices spike, in an effort to calm public panic.

“Look, inflation is all psychological,” Costanza explained. “If people think prices are going down, they’ll stop freaking out. So, we yell ‘Serenity now!’ until it works. It’s science—or close enough.”

Critics, however, worry that yelling might do little to solve actual economic problems. “This plan is nonsense,” said Senator Elizabeth Warren. “But I’ll admit, it’s still less confusing than quantitative easing.”

Forget behavioral economics—Costanza-nomics would argue that all human decisions boil down to “spite” or “snacks.”

International Reaction

Foreign leaders have been quick to comment on Costanza’s appointment. British Prime Minister Rishi Sunak reportedly chuckled and said, “Only in America.” Meanwhile, the European Central Bank issued a statement expressing “concern” and “utter disbelief” at the development.

Vladimir Putin, however, was less dismissive. “Costanza’s unpredictability is a strategic advantage,” he said. “Nobody knows what he’ll do next—not even him.”

Costanza’s First Day on the Job

Costanza’s first day at the Federal Reserve was, in his words, “a disaster, which means it was a huge success.” He arrived late after getting stuck in traffic, spilled coffee on his briefing papers, and mistakenly lowered the nation’s interest rates to -10% because “negative numbers feel opposite and opposites feel right.”

Still, the Costanza charm seemed to win over his staff. “He’s unconventional, sure,” said one Fed insider. “But at least he’s not boring. When’s the last time you had a chairman who quoted Seinfeld during a budget meeting?”

The American People Speak

Public opinion on Costanza’s appointment is as divided as ever. Some see it as a bold shake-up in a system that hasn’t worked for everyone, while others view it as a catastrophic joke.

“I’ve been saying for years that economists don’t know what they’re doing,” said Carla Jenkins, a bartender in Cleveland. “So why not George? At least he admits he doesn’t know either.”

Others were less optimistic. “I can’t believe this is real life,” said Alan Matthews, an accountant in Dallas. “What’s next, Kramer as Secretary of State?”

Legacy or Lunacy?

As George Costanza settles into his role as Federal Reserve Chairman, one thing is certain: his tenure will be memorable, if not effective. Whether his “do the opposite” strategy leads to economic recovery or global financial collapse remains to be seen.

For now, Costanza seems content. “Look,” he said at a recent press conference, “I don’t know much about economics. But I do know one thing: if every instinct I have is wrong, the opposite has to be right. That’s leadership, baby.”

Disclaimer:

This satirical article is intended for entertainment purposes only. If George Costanza is ever actually nominated for Federal Reserve Chairman, we’re all in much deeper trouble than we thought.

15 Observations About What Economists Could Learn from George Costanza

- George Costanza’s “do the opposite” philosophy might just be the answer to every economic crisis: “If every instinct I have is wrong, then the opposite must be right!”

- Economists often rely on models, but George would suggest throwing a dart at a board labeled “possible outcomes.”

- If economists followed George’s advice, every financial report would end with: “It’s not a lie… if you believe it.”

- George managed to live without a steady job for most of the ’90s—an economist might call that “maximizing leisure utility.”

- His approach to solving problems—lying or panicking—matches the mood of most markets during a downturn.

- George’s failed relationship with the stock market (and women) proves one thing: never invest in something you don’t understand.

- The Federal Reserve could take a cue from George’s technique of yelling “Serenity now!” whenever inflation spikes.

- Instead of discussing supply and demand, George would cut to the chase: “Why are people so selfish about their bread?”

- George proved you can save on housing costs by simply moving back in with your parents—a recession-era strategy economists could promote.

- Modern economists emphasize productivity, but George’s ethos says, “The less you do, the more people will expect.”

- George’s confidence in doing everything wrong could teach economists to embrace failure as a feature, not a bug.

- Forget behavioral economics—Costanza-nomics would argue that all human decisions boil down to “spite” or “snacks.”

- If central bankers started using George’s motto—“Leave on a high note!”—markets would see fewer crashes.

- George’s famous fake architect lie teaches us that economic modeling is basically convincing everyone you know what you’re doing.

- The Costanza principle for economists: “Why work to fix the problem when you can just nap under your desk and hope it goes away?”

Originally Published at FarmerCowboy.com

2025-01-20 22:34:02

Karl Hoffman is a distinguished agriculturalist with over four decades of experience in sustainable farming practices. He holds a Ph.D. in Agronomy from Cornell University and has made significant contributions as a professor at Iowa State University. Hoffman’s groundbreaking research on integrated pest management and soil health has revolutionized modern agriculture. As a respected farm journalist, his column “Field Notes with Karl Hoffman” and his blog “The Modern Farmer” provide insightful, practical advice to a global audience. Hoffman’s work with the USDA and the United Nations FAO has enhanced food security worldwide. His awards include the USDA’s Distinguished Service Award and the World Food Prize, reflecting his profound impact on agriculture and sustainability.